Is the first digital advertising recession on the way?

Is this the “first digital advertising recession?” Michael Nathanson from media consultancy MoffettNathanson thinks so, saying “We are living through the first digital advertising recession, the likes of which we’ve never seen before.”

Readers with long memories may recall the so-called dotcom boom and bust of the late !990s when a wave of internet-based businesses went bust because, while they could raise money easily from gullible investors, they failed to produce anything like the revenue needed to survive.

Today’s tech company travails have several strands: common to all is a vast decline in stock prices – an estimated $400bn in lost “value” – headed by Netflix on the streaming front and Meta (Facebook and Instagram) in advertising. Google is also suffering but less so as it doubles down on search and kicks its promise to abandon cookies into the long grass yet again. Even Amazon is having to face a more real world.

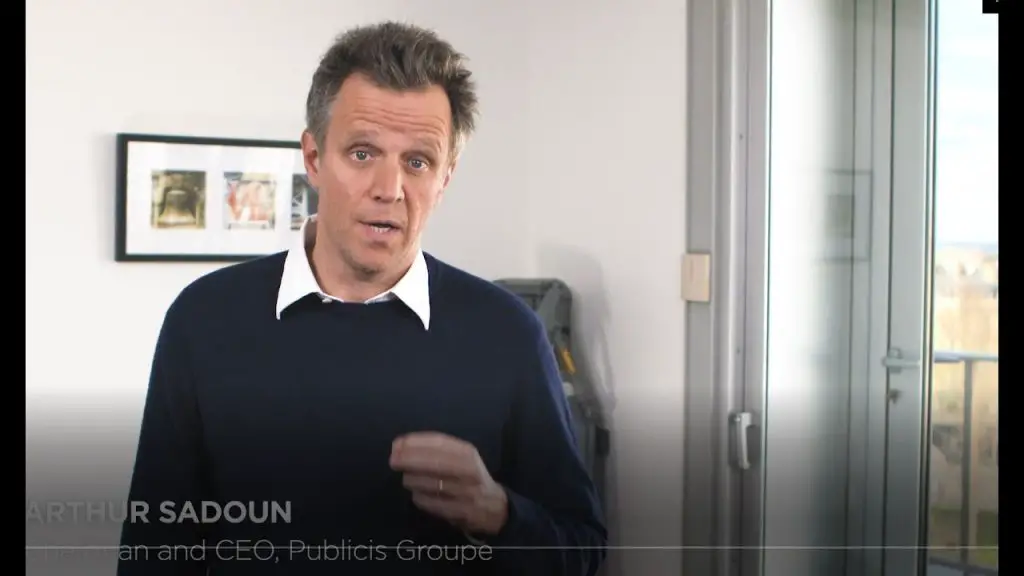

So there is a substantial clear-out going on and, sooner or later, it will hit agencies too. WPP reports its half year and Q2 numbers tomorrow and the odds are that it will follow Publicis, Omnicom, Interpublic and Havas by reporting a good revenue increase at around the !0% level.

But many of these ad holding groups’ businesses are so closely aligned to the likes of Facebook and Google that their woes are likely to spread and affect the performance of the big holding company-owned media agencies, in particular, which have so far seemed to defy gravity.

For them the first half of 2022 could be the calm before the storm.