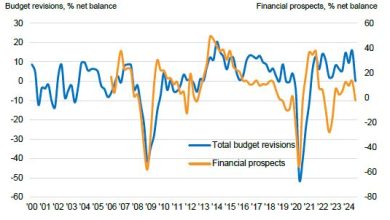

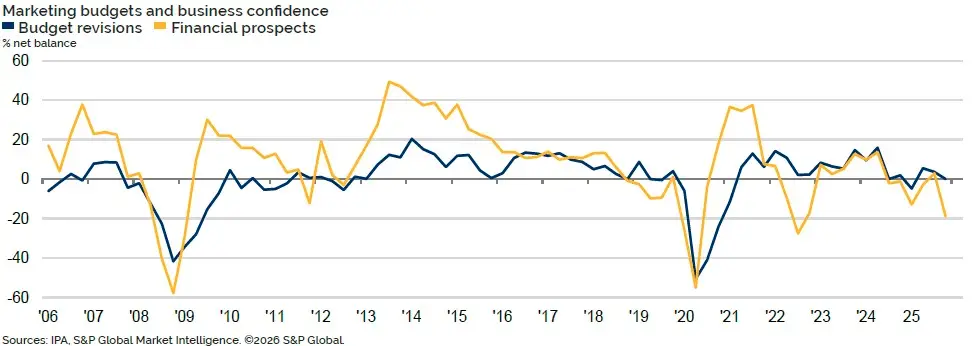

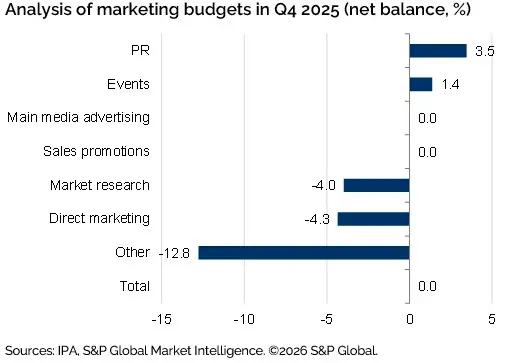

The latest IPA quarterly Bellwether survey found 57.4% of respondents with their marketing budgets unchanged in Q4, with the remainder evenly split between those reporting an increase and those making cuts.

In other words, marketing spending is becalmed in the same kind of lull that the UK economy as a whole is grappling with, in Q4 compounded by endless revisions as to what was in and what was out of chancellor Rachel Reeves’ budget. To add to the uncertainty the current government is embarked on what may be its 14th major policy U-turn (people have lost count) as it plans more aid for struggling pubs, undoing another budget measure.

Report author Maryam Baluchat at S&P Global Market Intelligence says: “2025 closed on neutral footing, with marketing budgets holding firm throughout the quarter as businesses exercised caution around major events such as the Autumn Budget.

“As we move into 2026, the economic climate remains challenging, with marketeers under pressure to deliver ROI as firms scrutinise spending decisions more harshly given the competitive market landscape and subdued macroeconomic outlook. That said, budgetary stasis points to some resilience, with cutbacks avoided. An anticipated easing of inflationary pressures and reduced borrowing costs in 2026 could spring business investment back to life this year.” S&P is forecasting 1.5% growth in 2026.