Magna and Zenith chart global digital transformation – good news for cybercriminals anyway

Publicis Groupe’s Zenith and Interpublic’s Magna media operations have been compiling their end of year assessments and forecasts for next year (suppose adland should be glad there is a next year.)

Magna first:

1/ In 2020 media owners’ linear advertising revenues decreased by an estimated -18% to $233 billion globally, amidst global economic recession, in line with MAGNA’s spring forecasts (-16%).

2/ Digital advertising sales slowed down but continued to grow through the COVID crisis: +8% to reach $336 billion (58% of total advertising transactions).

3/ Total global advertising revenues (linear + digital) shrank by $25 billion (-4.2%), down to $569 billion a milder decline than expected in June (-7.2%).

4/ Travel, automotive and restaurants made the heaviest advertising budget cuts while CPG/FMCG, finance and technology remained stable overall.

5/ Sixty-six of the 70 markets analyzed shrank this year. The world’s two largest markets, US (-1.3%) and China (+0.2%), were among the most resilient, while top ten markets declined between -4% and -8%.

6/ The Latin America region suffered the most (-11.3%), followed by EMEA (-6.4%) and APAC (-4.9%).

7/ Looking at 2021, COVID vaccination, economic recovery and delayed cyclical events will fuel a global rebound for marketing and advertising activity: +7.6% to $612 billion (linear: +3.5%, digital +10.4%, US +4.1%).

8/ Despite economic recovery, global linear advertising spend will remain $42 billion smaller (15% smaller) than the pre-COVID level of 2019.

9/ The US market resilience (-1.3% to $227 billion), despite one of the most severe COVID toll, was caused by the scale and organic growth of digital ad formats (+10%), while linear ad spend fell on par with global average (-16%).

10/ Record levels of political advertising spending brought $6.1 billion in incremental advertising sales and generated two percentage points of extra market growth that benefitted local TV ($3.6 billion) and, for the first time, digital media ($1.5 billion).

Now Zenith:

1/ Adspend is now forecast to shrink 7.5% in 2020, compared to July’s 9.1% forecast

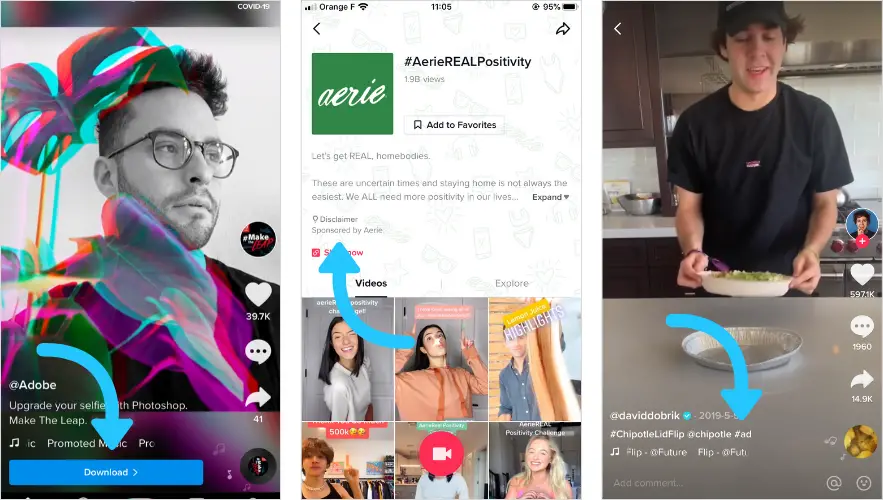

2/ The pivot to ecommerce will drive 1.4% growth in digital adspend

3/Connected (‘smart’) TV advertising to drive online video

4/ Retailer media to grow 46% (ads on sites like Amazon.)

And there’s lots more, especially from Zenith, but you get the drift. Everything’s going digital and direct.

At the same time the estimable Bob Hoffman’s newsletter pings in, reminding us (from various sources) that digital ad fraud is alive and kicking on.

Cybersecurity firm CHEQ estimates that ad fraud will create direct worldwide marketing losses of $35 billion in 2020, This about a 50% increase over their estimate of $23 billion in direct losses in 2019.

In another report Roberto Cavazos, economist at the University of Baltimore, says “the level of ad fraud is now staggering. The digital advertising sector has … higher fraud rates than multi-trillion-dollar sectors…” Among these are credit cards, ten times digital advertising’s market size.

So quite a lot of this digital growth that Magna and Zenith are expecting wil go into the pockets of n’er-do-wells.

Guess that’s progress for you…